Financial Services

A revolutionary customer experience driven by seamless AI interactions

The Conversational AI Revolution in Financial Services

The way financial firms conduct business and engage with customers is changing as a result of advancements in conversational artificial intelligence (CAI). Financial services organizations are increasingly turning to chatbots, voice assistants, and smart IVR systems to provide quick and convenient customer service, improve efficiency, and reduce costs as well as provide innovative solutions for their customers.

Tackle Less Obvious Use Cases

Aside from the more obvious chatbot roles, there are several other, less obvious uses for conversational AI in financial services beyond customer service and support.

Here are a few examples:

- Fraud detection: Chatbots and voice assistants can be used to help detect fraudulent activity by analyzing customer behaviour and flagging unusual or suspicious transactions.

- Compliance: Chatbots and voice assistants can be used to help financial services organizations ensure compliance with regulations by providing information and guidance to employees and customers, including providing specialist support & knowledge.

- Internal communication: Chatbots and voice assistants can be used to facilitate internal communication and collaboration within financial services organizations. For example, employees could use a chatbot to request information or assistance from colleagues, or to report issues.

- Loan applications & approval: Chatbots are set to streamline the process of loan approval. Bots make it easy to go through the process seamlessly by just answering questions on loan applications.

- Employee training: Chatbots and voice assistants can be used to provide training and education to employees within financial services organizations. For example, a chatbot could be used to provide information about new products or services, or to help employees stay up-to-date with industry developments.

- Market research: Chatbots and voice assistants can be used to collect and analyze customer data, providing valuable insights for market research and product development within financial services organizations.

- Pension assistance: Chatbots can also provide pension-specific information to resolve recurring customer support services issues.

Overall, there are many potential uses for conversational AI in the financial industry beyond customer service and support, including fraud detection, compliance, internal communication, employee training, and market research. As these technologies continue to evolve, we can expect to see even more innovative and useful applications in the financial services sector.

Why Use Conversational AI in Financial Services?

Let's take a closer look at some of the specific benefits which can be achieved by using conversational automations, e.g. chatbots and voice assistants, in financial services:

- Improved customer experience: Chatbots, voice assistants, and smart IVR systems can provide quick and convenient customer service, 24/7 whilst carrying across brand values. This can lead to improved customer satisfaction and loyalty.

- Increased efficiency: Conversational AI can handle simple tasks and frequently asked questions, freeing up human customer service representatives to focus on more complex issues. This can lead to increased efficiency and productivity.

- Cost reduction: Implementing chatbots, voice assistants, and smart IVR systems can help reduce the need for human customer service representatives, leading to cost savings.

- Personalization: Chatbots and voice assistants can use machine learning to offer personalized recommendations and advice based on individual customer needs and preferences.

- Scalability: Conversational AI can handle a large volume of customer inquiries and requests, making it easier for financial services organizations to scale their operations.

- Data collection and analysis: Chatbots, voice assistants, and smart IVR systems can collect and analyze customer data, helping financial services organizations to better understand customer needs and preferences, and to identify trends and patterns in customer behaviour.

Overall, the use of conversational AI in the financial industry can help improve the customer experience, increase efficiency, reduce costs, and provide valuable insights through data collection and analysis.

Conversational AI Challenges in Financial Services

Like any industry vertical, financial services poses a number of unique challenges for conversational AI implementations.

In financial services, security, data privacy and domain complexity mean there are a few key challenges that can be difficult to overcome in the wrong hands:

- Complexity of financial products and services: Financial products and services can be complex and difficult to explain, which can be a challenge for chatbots and voice assistants. These systems may not always be able to provide detailed and accurate information, and may need to be supplemented by human customer service representatives.

- Limited understanding of context: Chatbots and voice assistants may struggle to understand the context of a customer's enquiry or request, especially if it is phrased in a way that is difficult for the system to interpret. This can lead to confusion and frustration for the customer.

- Ethical concerns: The use of conversational AI in the financial industry raises ethical concerns, such as the potential for biased algorithms and the risk of data privacy violations. Financial services organizations need to ensure that their conversational AI systems are designed and implemented in a way that respects the rights and interests of their customers.

- Resistance to change: Some customers may be resistant to using chatbots, voice assistants, and smart IVR systems, and may prefer to speak with a human customer service representative. Financial services organizations need to consider this and provide options for customers who prefer human interaction.

- Implementation and maintenance: Implementing and maintaining chatbots, voice assistants, and smart IVR systems can be costly and time-consuming. Financial services organizations need to carefully consider the costs and benefits of these technologies before implementing them.

While the use of conversational AI in the financial industry offers many benefits, it is important for financial services organizations to carefully consider the challenges and take steps to address them.

Financial Services Conversation Design

Following best practices when designing conversational experiences for financial institutions is important if you want a successful project. You can read more about the approach we took with BNP Paribas Personal Finance.

- Identify the chatbot's goals and objectives: The first step in designing a chatbot is always to identify its goals and objectives. For a personal finance company, this might include providing information about products and services, assisting customers with transactions, and helping customers manage their finances.

- Determine the target audience: For a personal finance company, this might include both non-customers and returning customers. Understanding the needs and preferences of the target audience will help inform the design of the chatbot.

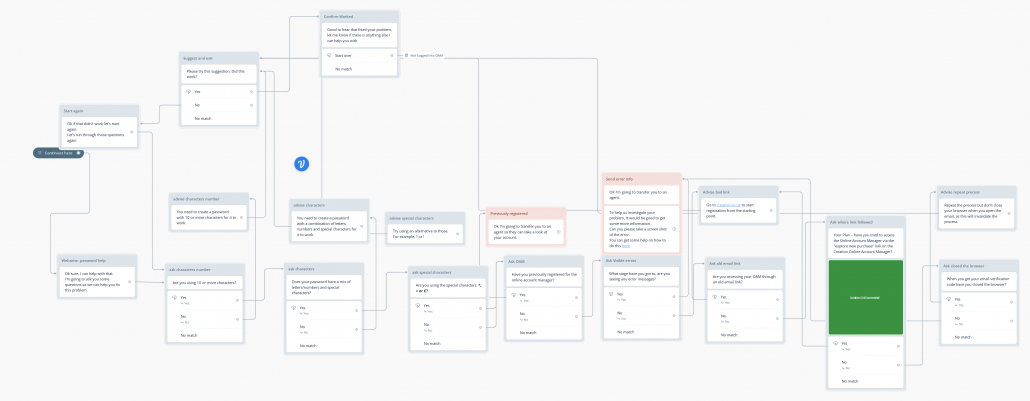

- Develop a conversation flow: This involves creating a map of the different paths the conversation could take, based on the user's input and the chatbot's responses. It is important to consider both non-customers and returning customers when designing the conversation flow.

- Design the chatbot interface: The chatbot interface should be designed in a way that is intuitive and easy to use for the target audience. This might include designing a user-friendly interface, using clear and concise language, and providing appropriate visual aids.

- Test and refine the chatbot: After the chatbot has been designed, it is important to test it and gather feedback from users. This can help identify any issues or areas for improvement, and allow for refinements to be made before the chatbot is launched.

The process of conversation design for a chatbot involves identifying the goals and target audience of the chatbot, developing a conversation flow, designing the chatbot interface, and testing and refining the chatbot.

Don't forget to consider both non-customers and returning customers when designing the chatbot to ensure that it meets the needs of its target audience.

You can read more about some of these specific conversation design processes by reading about the work we did with BNP Paribas Personal Finance.

Financial Services Conversational AI Platforms

Many organisations already have a cloud services provider, and most of these provide their own conversational AI platform.

Conversational AI Platforms tend to provide similar tools and capabilities, including:

- Natural Language Understanding (NLU) - the ability to understand free text questions using trainable models to improve their understanding

- System and custom entities

- Knowledge base parsing to intents or FAQ builders

- Speech recognition and speech synthesis

- Multi-language support

- Omnichannel integrations, to enable deployment of chatbot and voice projects across platforms including web, mobile, messenger and telephony

- Visual flow builders to design conversational flows

- Contextual Handling - a mechanism that allows the conversational agent to remember context from previous conversational turns in order to guide the flow of conversation

- Flexible ways to integrate with business logic and third-party systems to enable conversational assistants to fulfil their use-case

- Handover to live agent mechanisms

- Usage analytics platform

- Prototyping capabilities

- Testing and continuous integration

Major vendors provide similar feature sets as well as a selection of out-of-the-box NLU models and templates. Depending on the provider, some of these can be more specific to financial services use cases.

Measuring Success

We’ve looked at the benefits and challenges of implementing conversational AI to tackle financial use cases. We need to measure if a chatbot or voice assistant has been successful to ensure it's beneficial for the organisation and so we can see how to keep improving it.

There are several ways to measure the success of financial services chatbots and voice assistants:

- Customer satisfaction: This can be measured through customer surveys or through customer service ratings. High levels of customer satisfaction can indicate that the chatbot or voice assistant is effectively meeting customer needs and providing a positive experience.

- Usage and adoption: Tracking usage and adoption rates can also be a useful way to measure the success of financial services chatbots and voice assistants. If the number of customers using the chatbot or voice assistant is increasing over time, this can be a sign of success.

- Efficiency and cost savings: Financial services organizations can also measure the success of chatbots and voice assistants by tracking the efficiency gains and cost savings they provide. For example, if the use of a chatbot leads to a reduction in the number of customer service representatives needed, this could be a sign of success.

- Task completion rates: Tracking the percentage of tasks that are completed successfully by the chatbot or voice assistant can also be a useful way to measure success. A high task completion rate can indicate that the chatbot or voice assistant is able to handle a wide range of customer inquiries and requests effectively.

- Customer retention: Measuring customer retention rates can also be a useful way to gauge the success of financial services chatbots and voice assistants. If the use of a chatbot or voice assistant leads to an increase in customer retention, this could be a sign that the technology is providing a positive customer experience.

Overall, there are a variety of metrics that can be used to measure the success of financial services chatbots and voice assistants. It's important to choose the right metrics based on the specific goals and objectives of your organization.

Are Chatbots Fit For FinTech?

Absolutely. Conversational AI automations in the financial services industry can help improve customer satisfaction and loyalty, while also reducing costs and increasing efficiency.

However, it's important that best practices in conversational design are followed as well as utilising a complete strategy to continue to improve on chatbot or voice assistant implementations.

Ensuring your agent understands customer enquiries, provides a seamless experience, and adheres to data privacy laws are all important considerations.

As Natural Language Understanding (NLU) technologies, specifically large language models (LLMs), continue to evolve, we can expect to see even more innovative and useful applications in the financial services sector.

We're Trusted By...

Reliable Expertise

Google Cloud Partner

The Bot Forge an approved Google Cloud Partner.

We are also recognised, by Google, for Cloud Contact Centre AI expertise.

Highly Rated

The Bot Forge has been consistently chosen as one of the UK's top-ranked AI companies.

Our company is not only 5-star rated, but listed among the best on Clutch.

ManyChat Partner

As a ManyChat Agency Partner, The Bot Forge are recognised experts when it comes to building on top of the #1 chat marketing platform for Facebook Messenger.

Happy Clients

Testimonials

Jamie (Help For Heroes)

"I’m really pleased with the bot and services we’re getting from The Bot Forge. Since we started working with them, they completely lived up to their promises. The end-to-end process has been very slick.

The team was very straightforward to deal with. It was very much about them looking at how they could deliver in the quickest amount of time, with the least amount of investment required.

The Bot Forge understood our pain as a charity with a small team, and they took away a lot of the mystery and fluff from the process."

Chris (Director, Model Office)

"The Bot Forge provided custom software development services for a RegTech company. The team developed a compliance chatbot for the client's platform to provide guidance to their customers.

Excellent, very happy with the personalised services, accommodation of our specific needs within financial services. Their personable and innovative approach was impressive."

Emily (Xe.com)

"We came to The Bot Forge to gain an insight into Chatbot technology, its capabilities and its applications. We found them to be knowledgeable and insightful when discussing bots and AI.

We were particularly interested in how chatbots could help us save on customer service costs and provide a new channel for us to connect with new and existing customers.

The information which we obtained from speaking to The Bot Forge will be invaluable in making more informed decisions in the future about using this technology and we hope to work with them again."

Scott (CEO, Skin Check Champions)

"SPOT BOT has generated a few thousand unique users since its launch without any paid advertising or promotion. Every user is completely organic, spread (as designed) through shares and word of mouth, leading to thousands of skin checks booked and tens if not hundreds of skin cancers found.

A great first dip into the Messenger Bot pool which we're really excited to build on with Bot Forge as a vital partner... It's really lovely to work with them. Very clear communicators. Quick and efficient responses. Strong experience - well applied. BotForge are a really great partner, setting us up for success at all turns. Can't recommend this team enough."

Katie (Human Race Events)

"The Bot Forge offered a great service to us for the Saddleback Fred Whitton Challenge, which was really helpful for our customers and customer service team alike! They created a Facebook Chatbot based on the FAQs on the event website, which developed over time as more questions came up. Not only did this take some weight off our team and enhance customer experience, but it has also allowed us to better understand what information our riders are seeking, so that we can better answer their questions proactively through the website and social media. The team are always available at the drop of a hat, and eager to provide helpful solutions and developments."

Paul (Stitch)

"They’re responsive and organized, providing all the necessary information to track project progress.

The team is incredibly easy to work with. They took our idea and made it into reality."

Carolyn (Fred Whitton Challenge)

"I’m impressed with the chatbot it seemed to work well.

I think it is a good source of help and with it learning as it goes along it would answer lots of questions going forward.

If it cannot help it still contacts the organisers where we can answer."

Jack (Clifford Chance)

"The CIPS Professional Services Group (Procurement) approached The Bot Forge regarding consultancy and the creation of a demonstration Chatbot to support a conference presentation regarding industry 4.0 Technology. This was shown in front of ~100 Procurement professionals on December 2018 at Clifford Chance (London).

The Demonstration Chatbot was brilliant and we received really good feedback on the idea and execution. The Bot Forge perfectly met our requirements.

The team at Botforge will do everything they can to ensure your project is a success at the right price to suit budget! Would fully recommend!"